Paypal Nigeria Issues Resolved 2023!

Paypal Nigeria Issues Resolved 2023!

In This Review

A lot of Nigerians have had problems running their online businesses online majorly due to the unavailability of Paypal which is one of the most accepted payment methods worldwide. So if you’re an online vendor or business person whose business depends on customers on the international scene, you might have also come to that glitch in the area of receiving payments internationally.

In this article, I will be answering these important questions;

- How to open a working Paypal in Nigeria.

- How to activate Paypal in Nigeria.

- How to receive Paypal funds in Nigeria.

- How to get a US bank Account in Nigeria that works with Paypal.

- Why some virtual US Bank Accounts do not work with PayPal?

- Why does PayPal block your account and hold money for 180 days?

- Conclusion

How to open a working Paypal Account in Nigeria.

First, let me correct the misconception. Nigerians are not banned from using Paypal, rather they are restricted from using certain features, one of which is the ability to receive money into their personal Paypal account. Although using a business Paypal account, there is one way to receive money and that’s by making Paypal one of your payment gateways on a website. That is not good enough as the majority of vendors online do not operate in this manner.

The easiest way to get the full functionality out of PayPal is to use a non-Nigerian PayPal. Don’t worry, it is not as complicated as it sounds. I am going to walk you through every step in this guide. You do not need a VPN to do this, Paypal has an extension to their domains for various countries which is not limited to their geographical IP addresses. For this guide, we are going to use PayPal Lesotho.

Click here to open a Paypal account.

Click on the signup button and on the next page, click on a business account. Note that if you choose the personal option, you might experience complications in the long run.

On the next page, you will be asked to provide your business email address. Make sure it’s an address you have access to because you will be asked to verify it.

On the next page, you will need to tell PayPal a little bit about your business. Select from the dropdown menu.

The next page will require a phone number for your business, change the international code spot from Lesotho to Nigeria, then type in your Nigerian phone number. The next page will require you to upload a valid ID card and then you are done.

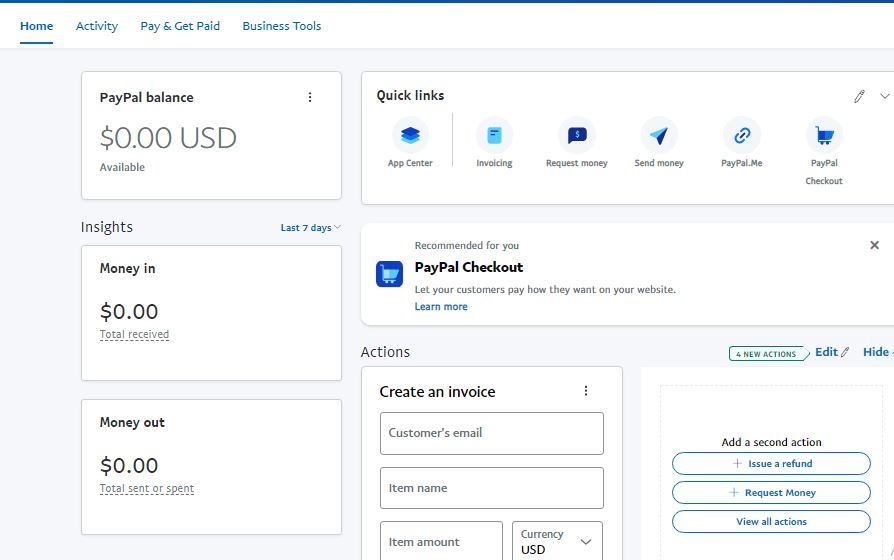

You will be taken to a page like the one below. This is what a fully functional PayPal account looks like.

How to activate Paypal in Nigeria.

Even though the process is all done, you might still be prompted for phone number verification which must be a Lesotho number, do not fret. If it ever comes to this, kindly reach out to us via Whatsapp and we will be glad to fix it for you.

How to receive Paypal funds in Nigeria.

Now, owning a fully functional PayPal account is just halfway through the journey of getting your USSD to your personal account in Nigeria. You need a US Bank number which you will connect to your PayPal account in order to make a withdrawal. The goto solution used to be Payoneer but new Payoneer account holders will now be met with a stumbling block. You need to have made a minimum of $50 to be able to get a US virtual account number. Joined with the extra fees, Payoneer is predicted to soon be out of fashion in the evolving business world.

The good news is that there are a lot of platforms now offering virtual US account numbers to Nigerians. The bad news is that not all of them will work for PayPal. Not to worry, we have made our investigations and figured out which will work best for you.

How to get a US bank Account in Nigeria that works with Paypal.

Getting a US Bank account number in Nigeria some years bank would’ve been something one might think to be almost impossible. Thank goodness for the daily innovations, the possibilities in this world are becoming endless. Numerous companies now offer US Bank account to noncitizens and you too can take advantage of it. You need to beware though, instead of wasting your time, knowing why exactly you need a US Bank account will guide you to knowing which platform to work with. For example, Grey is a popular platform where you can generate your own US bank account but unfortunately, you cannot use this account for your PayPal issues. I will explain why in the next subheading. Let’s go straight to getting you a suitable account number for your PayPal account.

Geegpay.Africa

GeegpayAfrica is a leading platform providing solutions to payment methods for businesses all over the world and has been steadfast in providing Africans with virtual accounts. Register on the platform, request a US Dollar account and you’re all set and armed with something that should work with PayPal.

If you encounter issues with setting up your bank account with Paypal, reach out to their customer care and they will help you sort it out after you verify a few things.

Why some virtual US Bank Accounts do not work with PayPal?

As I explained above, some virtual US bank accounts will not work for your PayPal account, you will only end up wasting your time after adding up the account. Many of these virtual accounts operate via wire transfer and PayPal operates ACH.

Both ACH and wire transfers work in a similar way, but with different timelines and rules. Wire transfers are direct, generally immediate transfers between two financial institutions. ACH transfers, meanwhile, pass through the Automated Clearing House and can take up to a few business days.

So your assignment is to find out what your financial institution operates by. The option we provided up there will work perfectly for PayPal.

Why does PayPal block your account and hold money for 180 days?

Even though we can now use PayPal in Nigeria, you have to know that your account is also sending signals through your IP address. Using a VPN will not help you and may rather complicate issues for you. The simple thing to do is abide by every PayPal rule. Make sure every money you receive has an invoice or the sender should clarify its F&F.

But if you have encountered the 180 days issue, there is no other option with PayPal, you have to wait it out. You can also follow this guide to get your money out after 180 days.

Conclusion

Using PayPal in Nigeria can be tedious but I am hoping this guide will help resolve whatever hindrances that have obstructed you from enjoying the benefits that come with using PayPal services.

If you need help with any of these, kindly reach us via our Contact Page or on Whatsapp

NOTE THAT THERE IS A CONSULTATION FEE